You’ve got the next big thing in fashion. Your designs are Instagram-worthy, your friends love your products, and you’re ready to take Amazon by storm. Fast-forward six months, and you’re staring at a mountain of storage fees and a 90% return rate, and you’re wondering where it all went wrong.

I’ve seen this story play out dozens of times. Fashion brands treating Amazon FBA mistakes like generic e-commerce problems only to discover the fashion space has its own brutal learning curve.

“Fashion is one of the most competitive and saturated niches. The mistakes here don’t just cost money; they can kill your brand before it gets started.”

The reality check most fashion entrepreneurs need: Selling on Amazon successfully requires treating it as your primary growth channel, not an afterthought. When 80% of US households start their product searches on Amazon, common Amazon FBA mistakes in fashion mean handing profitable customers to competitors while you’re explaining to investors why Amazon just charged you to destroy thousands of dollars in unsold inventory.

For fashion brands serious about Amazon success, partnering with experienced Amazon agency services can mean the difference between expensive mistakes and profitable scaling.

Why Fashion Brands Fail to Scale on Amazon

The fashion industry runs on emotion and trend cycles that change faster than Amazon’s algorithms can adapt. Yet most new sellers approach fashion like they’re selling phone chargers. Big mistake.

Amazon operates with over one million robots across its fulfillment network (milestone reached around July 2025). This massive automation makes it incredibly efficient at moving standard products. But fashion? Fashion has emotional buyers, size variations, seasonal demands and return rates that can hit 90% if you screw up your size chart.

The killer misconception: treating Amazon as a backup sales channel. This mindset kills your scaling potential faster than long-term storage fees eat your profits.

Account-Related Mistakes That Kill Fashion Brands

The Wrong Business Structure Trap

Setting up your Amazon business under the wrong legal entity will bite you when you try to scale. I’ve watched fashion brands scramble to convert from sole proprietorships to LLCs mid-growth, only to get tangled in Amazon’s verification maze.

Here’s what most guides don’t tell you. Amazon’s Brand Registry process becomes a nightmare when your business structure changes after you’re already selling. The platform cross-references your legal documents with your seller account, and any inconsistencies trigger verification delays that can shut down your sales for weeks.

Get this right from day one. Your future self will thank you when you’re applying for Brand Registry instead of explaining to Amazon why your business name doesn’t match your bank account.

Origin Story Problems

Lying about where your products come from will get your account suspended faster than writing fake reviews. I’ve seen fashion sellers claim “Made in USA” when their trendy crop tops ship from China. Amazon’s fraud detection algorithms cross-reference shipping origins with product claims, and getting caught means potential permanent bans.

The verification process isn’t just checking paperwork anymore. Amazon analyzes supplier shipping data, customs records and origin claims. One inconsistency flags your account for manual review, which means weeks of sales suspension while you prove you weren’t actually trying to mislead customers.

Product-Related Mistakes: The Fashion Edition

Skipping Fashion-Specific Research

Generic product research tools will steer you wrong in fashion. While seller tools like Helium 10 and JungleScout provide data, fashion success requires understanding emotional purchase drivers and subcategory nuances.

Take underwear. Sounds simple, right? Wrong. It’s a wide niche, but it also has a lot of subcategories. Each subcategory has different customer psychology, search patterns and competitive landscapes.

The counterintuitive truth about competition: Zero competitors often means zero demand, not a blue ocean opportunity. High competition signals market demand. Your job is finding the specific angle where you can compete effectively.

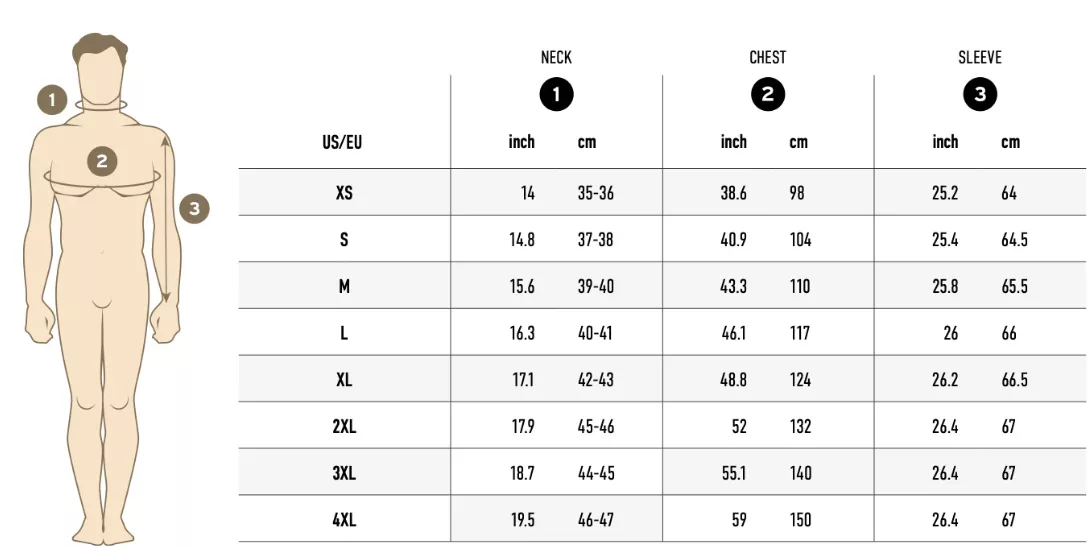

The Size Chart Catastrophe

Nothing kills fashion sales faster than inaccurate sizing. You could have a 90% return rate because your size chart was not accurate. In fashion, returns aren’t just lost sales — they’re profit killers that destroy your inventory velocity and search rankings.

Create detailed size charts with multiple measurement points, include fit descriptions, and consider the psychological aspects of sizing. Many successful fashion sellers actually size up slightly to make customers feel better about their purchase.

|

Size Issue |

Cost Impact |

Prevention Strategy |

|

Wrong measurements |

90% return rate |

Multi-point size charts |

|

Poor fit descriptions |

High customer complaints |

Include fit notes and model stats |

|

Missing size guides |

Increased returns |

Video size demonstrations |

One fashion seller we worked with reduced return rates from 48% to 28% just by improving size chart accuracy.

Inventory-Related Mistakes: Fashion’s Biggest Profit Killer

The Seasonal Nightmare

Fashion’s seasonal nature creates cash flow disasters that generic inventory advice doesn’t address. Forget your Halloween costumes in Amazon’s warehouse, and you’ll pay long-term storage fees that wipe out entire profit margins.

Here’s the part most sellers miss: Amazon doesn’t care about your fashion calendar. Their fee structure treats seasonal fashion items like any other slow-moving inventory. Those cute Halloween dresses sitting unsold in November? You’re paying premium storage rates until you remove them.

Set automatic removal orders for seasonal items 30 days before storage fee dates. This maximizes the selling window while avoiding the fee cliff. Some sellers think this means lost sales opportunities, but the math is brutal — those storage fees often exceed your gross margins.

The Color and Size Forecasting Disaster

Fashion inventory forecasting requires understanding customer behavior patterns that don’t exist in other categories. Let’s say you have 5,000 yellow T-shirts in a size 2 but are only selling those in much larger sizes.

This isn’t just about lost money on unsold inventory. You’re missing sales in the sizes customers actually want while paying storage fees on the sizes they don’t. The opportunity cost compounds when your out-of- stock listings drop in search rankings.

Weight Limits and Fashion Don’t Mix

Fashion’s emphasis on packaging and presentation often leads to weight limit violations. Amazon employees will return your entire shipment if you exceed weight limits on pallets, leaving you with shipping costs, return fees and out-of-stock listings during peak selling periods.

Fulfillment-Related Mistakes That Scale Backward

FBA Label Catastrophes

Missing required FBA labels on fashion items isn’t just inconvenient — it’s expensive. Amazon charges significant fees for relabeling, and delays in processing mean you’re out of stock during crucial selling windows.

Fashion items with multiple variations (size, color, style) create labeling complexity that trips up even experienced sellers. Each variation needs specific handling, and mistakes compound quickly across large shipments.

The Prime Day Preparation Disaster

Missing FBA cutoff dates for major sales events like Prime Day will destroy your quarterly results in fashion. Customer demand spikes during these events, but if your inventory isn’t processed in time, you’re watching competitors capture sales that should be yours.

Fashion buyers are particularly event-driven. They shop for specific occasions, seasonal needs and trend moments. Missing Prime Day or back-to-school shipping deadlines means missing the entire demand cycle, not just a few days of sales.

Pricing-Related Mistakes: The Fashion Psychology

The Race to the Bottom Trap

Being cheaper than everyone else doesn't work. In fashion, being the cheapest option signals poor quality to customers.

“As consumers, we don’t buy the cheapest option because we assume it’s cheap quality.”

Fashion is emotional purchase behavior. Customers use clothing to express personality and social status. Competing solely on price misses the psychological drivers that generate profitable sales in this category.

I’ve watched fashion sellers destroy their brands by racing to the bottom on price. Once customers associate your brand with “cheap,” climbing back up the value ladder is nearly impossible. It’s better to price in the middle-to-upper range of your competitive set and focus on differentiation.

Unit Economics Blindness

Fashion’s complex cost structure trips up sellers who don’t calculate all the hidden expenses. Materials, manufacturing, shipping, Amazon fees, returns processing — the costs add up faster than you think.

If you’re selling dresses for $12 when Amazon charges $7 for shipping, you’re not covering overhead, let alone making profit. Sellers focus on the sticker price without calculating true unit economics.

Include everything in your calculations: FBA fees, storage fees, return processing, advertising costs and the cost of unsold seasonal inventory. Most profitable fashion sellers need 40%–50% margins to account for returns and seasonal adjustments. Anything less and you’re gambling with your cash flow.

Listing and PPC-Related Mistakes

Amazon SEO vs. Fashion Psychology

Amazon SEO for fashion requires balancing search algorithms with emotional purchase triggers. Generic pricing strategies that work for electronics fail in fashion where lifestyle imagery and emotional connection drive conversions.

Customers need to visualize themselves wearing your designs. This means lifestyle photos, A+ Content that tells a story and copy that connects with the emotional reasons people buy fashion items. The functional benefits matter, but the emotional ones close the sale.

PPC Strategy for Fashion’s Unique Challenges

Running Amazon PPC campaigns without understanding fashion’s seasonal patterns and emotional triggers will drain your budget fast. The keyword “dress” costs a fortune and delivers low-converting traffic because it’s too broad.

Focus on long-tail keywords that capture specific fashion needs. “Black cocktail dress for wedding guest” converts better than “black dress” and costs significantly less per click. The more specific the intent, the higher the conversion rate and the lower your advertising costs.

|

Keyword |

CPC |

Conversion Rate |

|

“black dress” |

$1.80 |

1.2% |

|

“black cocktail dress wedding guest” |

$0.75 |

6.8% |

The Profitable Path Forward

Despite the challenges, selling on Amazon in fashion can generate serious profits when you avoid these mistakes. The key is treating Amazon as your primary growth channel, not a side project.

What works in fashion:

-

Understanding specific customer needs within fashion subcategories

-

Building inventory strategies that account for returns and seasonality

-

Creating listings that combine Amazon SEO with emotional purchase drivers

-

Implementing pricing strategies that position your brand correctly within customer psychology

The brands that scale successfully respect Amazon’s complexity while leveraging fashion’s emotional purchase behavior. They study subcategory dynamics, plan inventory around seasonal patterns and price for perceived value rather than racing to the bottom.

Understanding the Challenges

Amazon FBA mistakes in fashion are business killers that can destroy your scaling efforts before they start. The fashion industry’s unique challenges around sizing, returns, seasonality and emotional purchasing require specialized strategies that generic Amazon advice simply doesn’t cover.

Fashion brands that dominate on Amazon understand that it isn’t just another sales channel. It’s a complex ecosystem that requires preparation and fashion-specific expertise. Whether you’re forecasting inventory for seasonal trends or optimizing listings for emotional fashion buyers, the details matter more in fashion than almost any other Amazon category.

The brands that win approach Amazon with the seriousness it deserves. They invest in proper business setup, understand their unit economics, plan for high return rates and build systems that can handle fashion’s unique operational challenges.

Ready to scale your fashion brand on Amazon? Learn more about professional Amazon marketing strategies and Amazon PPC management to avoid these common Amazon mistakes. Work with specialists who understand the unique challenges fashion brands face when scaling on Amazon’s platform.

FAQ

What is an Amazon FBA seller?

An Amazon FBA (Fulfillment by Amazon) seller is someone who uses Amazon’s logistics network to store, pack and ship their products to customers. Amazon handles customer service and returns, while sellers focus on product sourcing and marketing.

What are the main mistakes fashion brands make on Amazon?

The biggest mistakes include treating Amazon as a secondary channel, poor inventory forecasting for sizes and seasons, inaccurate size charts leading to high return rates, competing only on price rather than value and not understanding fashion-specific customer psychology.

How can fashion brands succeed on Amazon FBA?

Success requires treating Amazon as a primary sales channel, conducting thorough research into fashion subcategories, maintaining accurate size charts, pricing for perceived value rather than competing on price alone and implementing inventory strategies that account for seasonality and high return rates.

Is Amazon FBA profitable for fashion brands?

Yes, Amazon FBA can be highly profitable for fashion brands when managed correctly. But fashion requires higher margins (typically 40%–50%) to account for returns, seasonal inventory challenges and the competitive nature of the category. Brands must focus on differentiation and customer experience rather than just low prices.

Related Articles

SEO for Moving Companies: Boston Edition

Local SEO is a highly effective tool to make your moving company known in Boston and attract more quality website traffic. Read how SEO can help you outgrow competitors and top the Google SERP chart in 2026!

Word-of-Mouth Won’t Save Your Moving Company. Here’s How to Actually Streamline Leads [Research & Industry Insider Tips]

Relying on referrals isn’t enough to grow your moving company. Discover proven strategies to diversify lead sources and streamline client acquisition with insider tips.

Electrician Digital Marketing: 11 Tips to Get Your Business on Top

Digital marketing for electricians can be tricky, but it is an indispensable tool for brand visibility. Discover how to leverage digital marketing to get more customers for your electrical company in 2026!