The Post-Holiday Visibility Gap: How to Win When Everyone Else Is Offline

Everyone feels kind of weird in that liminal space between December 26 and mid-January where half your marketing team is hibernating under weighted blankets and the other half is nervously snacking while eyeing their Q1 goals.

You know the vibe — everyone’s convinced consumers have stowed their wallets, ad budgets are gone, and it’s time to finally take that vacation you’ve been promising yourself since October.

But while you’re offline, there’s a gold rush happening.

Welcome to Q5 (It’s a Thing)

Marketing nerds have dubbed this period “Q5” — the secret fifth quarter that doesn’t appear on any calendar but shows up loud and clear in the data. And 87% of Q5 shopping occasions end in a purchase, making it one of the most high-intent periods of the entire year. Not October. Not even Cyber Monday. This awkward post-holiday window.

Think about it. While your competitors are posting “see ya in January!” auto-replies, shoppers are armed with gift cards (the National Retail Federation reports $29 billion in holiday gift card spending), holiday cash and a burning desire to treat themselves after spending weeks buying for everyone else. According to Google’s research, 74% of post-holiday shopping occasions are still for gifts (hello, belated presents and exchanges), while 60% of shoppers are browsing online for personal purchases.

The best part? CPMs drop like a stone. Meta saw CPM rates fall by roughly 29% from late November to post-Christmas, while Instagram dropped a whopping 35%. Yep, you can reach the same audience for a fraction of the cost while everyone else is MIA.

“I personally used to think the time between Christmas and New Year was just pure ‘brain-off’ mode. Until I caught myself doom-scrolling on my phone and getting hooked by a colorful ad that made me think, ‘Wow, Clare would love this.’

One minute later — extra gifts for a friend, something for myself, checkout completed. ?

And then it hit me: If I, a pretty seasoned marketer, fall for this, imagine everyone else. That post-holiday gap is such an underrated moment — brands either show up boldly or fade into the background. No in-between. So if you were waiting for a sign — this is IT. Go get them!” — Nataliia Popelniukh, CEO at Netpeak Agency US

Why Brands Ghost (And Why That’s Your Opportunity)

Your team survived Black Friday, Cyber Monday and endless “ships by Christmas!” campaigns. By December 26, everyone’s toast, budgets are blown, and leadership’s already obsessing over Q1.

So brands go dark. Crickets-and-tumbleweeds dark.

But consumer behavior doesn’t take a vacation. Research from Think with Google shows shoppers are more likely to buy after the holidays than during peak season. Plus, advertisers who stay active see 70% more visits and 25% higher conversion rates compared to non-Q5 periods.

So maybe trying to stay awake when everyone else hits snooze.

The Psychology of Post-Holiday Shopping

Post-holiday shoppers operate in a completely different headspace. The shift is massive:

Holiday Shopper: Stressed, time-crunched, gift-focused, comparing deals across 63 open tabs, overthinking Aunt Susan’s candle.

Q5 Shopper: Relaxed, browsing for themselves, using gift cards, ready for “New Year, New Me” energy without that December panic.

This creates four distinct Q5 shopping motivations:

-

Gift card redemption — People don’t just spend the exact value of their gift card. They bundle, they upgrade, they add items.

-

Self-gifting — After weeks of buying for others, consumers feel justified (even obligated) to treat themselves. Among devoted shoppers specifically, 57% buy themselves gifts during Q5.

-

Post-holiday sales hunting — About 71% of consumers plan to shop the week after Christmas, hunting deals that are often better than Black Friday.

-

New Year’s resolution prep — Fitness apps, productivity tools, organizational products, wellness subscriptions — these categories explode in January. Over half of Americans surveyed planned to improve their physical health as their 2025 resolution.

The Brands That Nailed It

Let’s look at some brands that understood the assignment:

Ghia (Non-Alcoholic Beverages)

Ghia absolutely owns Dry January. They created a full content series with zero-proof cocktail recipes and a printable Dry January calendar. Users could make a different non-alcoholic cocktail each day, checking them off as they went. It was engaging, shareable and aligned perfectly with the resolution mindset.

Why it worked: They gave people a tool to support their goals (not just a product), made it interactive and tapped into a growing cultural movement.

Flamingo Estate

Every January 1, Flamingo Estate launches their annual Petrichor candle (that awesome smell after it rains) drop with messaging like “wash away what no longer serves you, and turn over a new leaf.” Limited-edition launches create urgency and play directly into the “fresh start” psychology of January.

Why it worked: It’s not just a candle; it’s a ritual for the new year.

Aldi (Veganuary Campaign)

Aldi went all-in on Veganuary, expanding their Plant Menu and promoting it heavily in January. Last year, their plant-based sales increased by 500%. Yes. Five. Hundred. Percent.

Why it worked: They identified a massive cultural moment (Gen Z is the most vegan generation in history) and positioned themselves as the accessible solution.

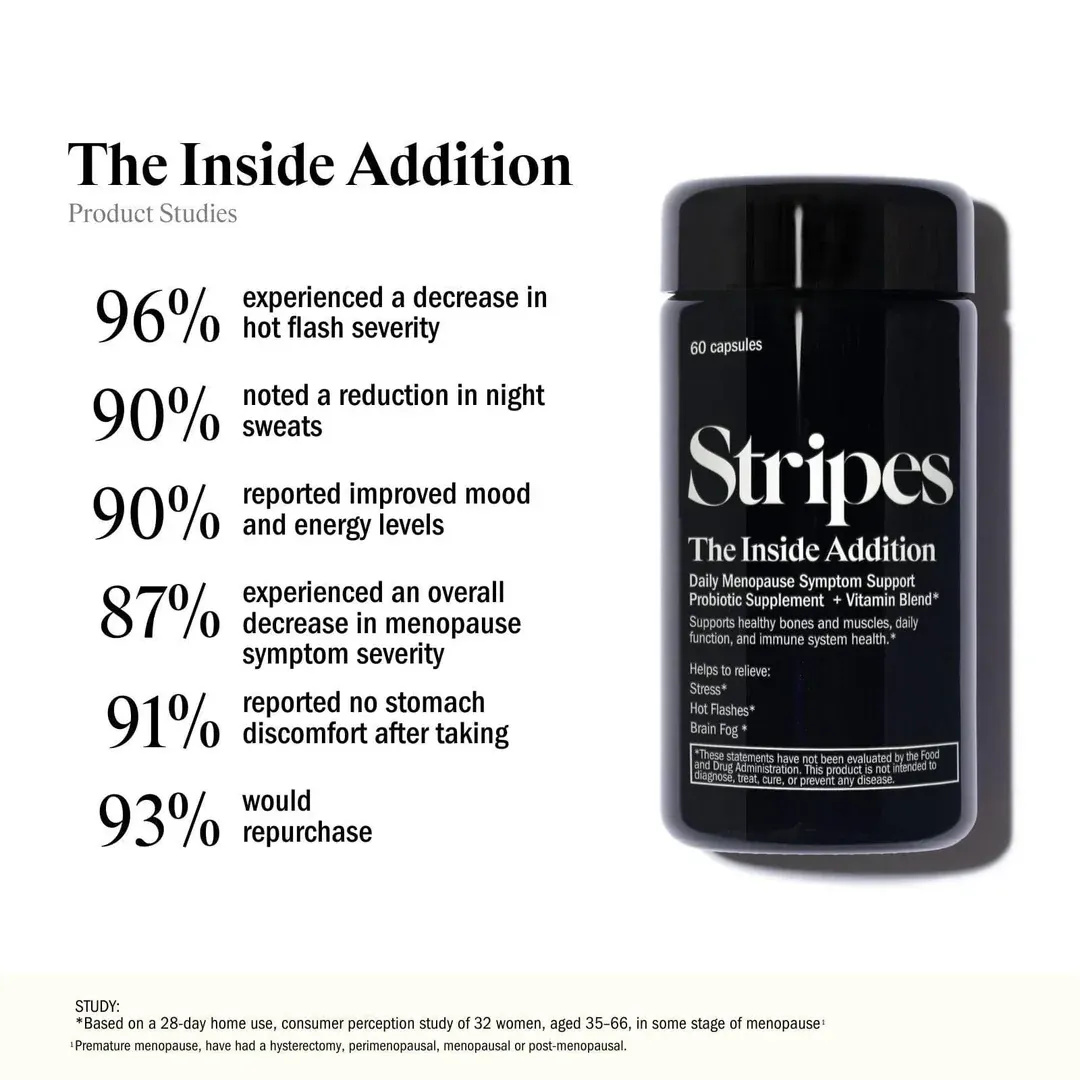

Stripes (Menopause Wellness)

Stripes flipped the script on “New Year, New You” with their campaign: “Same you, but better supported.” Instead of pushing transformation, they offered acceptance and practical support for managing menopause symptoms.

Why it worked: Authenticity over aspiration. They met customers where they were instead of demanding they change everything.

The Strategies: How to Actually Win Q5

For Social Media Marketers: Your Secret Weapon During Q5

This is wild: While brands slash their social budgets post-holidays, engagement doesn’t drop — it just shifts. People are home, scrolling more and actually have time to interact with content (unlike the December chaos). This is your moment to dominate feeds while competitors nap.

Refresh Your Creative (Seriously, Ditch the Snowflakes)

Your audience is over holiday aesthetics. Swap festive visuals for fresh, January-appropriate content: clean minimalism, “new year energy” vibes, organizational content, wellness themes. Think less red and green, more white space and aspirational lifestyle shots.

Double Down on User-Generated Content

Launch “New Year, New Goals” UGC campaigns. Ask followers to share their resolutions, post-holiday wins or how they’re using your product in January. Create a branded hashtag (like #FreshStartWith[YourBrand]), and feature the best submissions. UGC is free content and social proof — plus people love to be featured.

Capitalize on Lower Ad Costs

Remember those CPM drops? Social ad costs plummet in Q5. This is the time to test new audiences, experiment with creative formats and scale what worked in Q4 — but for less money. Set up retargeting campaigns for holiday browsers and look-alike audiences based on your best December customers.

Jump on January Trends Early

Dry January, Veganuary, New Year’s resolutions, organization hacks — these trends explode on social in January. Create content around them before they peak. Tutorial content, how-to Reels, transformation posts (but make them realistic, not annoying), and “day in the life” content all perform exceptionally well.

Use Stories and Reels to Stay Top of Mind

Stories don’t require perfect production value — they just require consistency. Post daily behind-the-scenes content, quick tips, polls about New Year goals, countdowns to sales. Reels showcasing “fresh start” content, organization tips or resolution-friendly products tend to go viral in January when people are actively seeking inspo.

Engage Like Your Job Depends on It (Because It Does)

Q5 is quieter, which means you can actually respond to every comment and DM without drowning. This extra attention builds community and turns casual followers into loyal customers. Ask questions in your captions, respond with personality and create conversations — not just broadcasts.

Host Virtual Events or Challenges

Launch a January challenge (7-day wellness challenge, 30-day organization challenge, etc.) that gets followers participating daily. This creates recurring engagement, gives you daily content and positions your brand as a community leader. Plus, challenges are highly shareable.

Leverage Influencer Partnerships at Discount Rates

Influencers are also recovering from Q4’s insanity. Many are more available and negotiable in January. Partner with micro-influencers (10K–100K followers) who have authentic engagement for Q5 campaigns. They’re cost-effective and often deliver better ROI than mega-influencers.

Track What Actually Matters

Stop obsessing over vanity metrics. In Q5, focus on engagement rate (are people actually interacting?), click-through rate (are they visiting your site?), conversion rate (are they buying?), and cost per acquisition. Q5 is your testing ground for Q1 strategies.

For B2C Brands: Don’t Let the Momentum Die

Extend Your Sales Window — Half of shoppers enjoy post-Christmas shopping. Run “New Year Refresh” sales or clearance events that feel fresh, not leftover.

Activate Gift Card Campaigns — Send reminder emails: “You’ve got $50 — here’s how to use it” messages with recommendations and free shipping bonuses.

Lean Into Resolutions (But Make It Real) — If your product ties to resolutions (fitness, organization, wellness), January is your Big Game. But skip toxic “fix yourself” messaging. Supportive beats shame-based every time.

Retarget Holiday Browsers — Those Black Friday visitors who didn’t buy? They’re still out there, but they’re tired of hearing Mariah. Retarget them with fresh creative and post-holiday messaging.

For B2B Brands: Stay Visible While Competitors Vanish

Your buyers didn’t stop working just because it’s January. Q4 and early Q1 are critical for B2B — decision-makers are finalizing budgets and seeking partners to crush the year ahead.

Don’t Go Dark — While competitors pause, you dominate mindshare. CPMs are lower, acquisition costs are cheaper. If your marketing disappears, someone else is filling the gap.

Focus on Q1 Planning Content — Create “2026 Strategy Templates,” “Q1 Goal-Setting Frameworks,” positioning your brand as a strategic partner, not just a vendor.

Thank-You Campaigns That Convert — It’s renewal season. Personalized appreciation can tip the scales toward contract renewals.

Leverage Budget Surplus — Companies with unspent Q4 budget need to use it or lose it. “Secure your 2026 contract now” captures this urgency.

Host “Year in Review” Events — Celebrate customer success stories, make it conversational, not promotional. Community content builds trust without the hard sell.

For E-Commerce: Convert Holiday Traffic Into Loyal Customers

Abandoned Cart Sequences — Holiday shoppers left tons of carts. Re-engage with fresh angles: “Still thinking about it?” or “New Year discount just for you.”

Post-Purchase Upsells — Holiday buyers are warm leads. Hit them with complementary products or “You might also like” bundles.

Loyalty Programs on Steroids — Reward holiday customers with double points in January, early access to launches or VIP perks.

Smart Inventory Clearance — Bundle slow movers with bestsellers. Frame as “Fresh Start January,” not “Please buy our leftovers.” Use countdown timers for urgency.

7 Common Mistakes

Treating Post-Holiday Like a Dead Zone — Q5 shoppers are engaged, decisive and high-intent. Going offline means leaving money on the table.

Recycling Holiday Creative — Your audience is over Santa. Refresh your creative to match a Q5 mindset: resolutions, self-care, fresh starts.

Forgetting Mobile — 60% of web traffic is mobile. If your checkout isn’t frictionless, you’re bleeding conversions.

Ignoring Segmentation — Not everyone has the same Q5 needs. Segment by behavior: holiday buyers (upsell), browsers (re-engage), new visitors (introduce).

Going Silent on Social — Keep posting. UGC, behind-the-scenes moments, New Year tips — anything that keeps you top of mind costs nothing. Organic social is free real estate; use it.

Only Focusing on Discounts — Offer value beyond price: free shipping, extended returns, loyalty rewards, better service.

Using the Same Social Content Strategy — What worked in December won’t work in January. Holiday nostalgia is out; fresh starts are in. Adjust your content pillars, update your visuals and refresh your messaging to match the Q5 mindset.

The Often-Overlooked Q5 Goldmines

Social Listening for Q5 Opportunities — Monitor what your audience is actually talking about in January. Are they sharing gym selfies? Meal prep content? Organization wins? Jump into those conversations with relevant content and products. Social listening tools can reveal untapped content opportunities your competitors are missing.

Gift Card Upsells — Incentivize spending beyond the card value: “Use your gift card and get free shipping on orders over $75.”

Belated Gift Campaigns — 74% of Q5 shopping is still for others. “It’s never too late” or “January birthday” promotions work. And think of those poor folks who have January birthdays.

Return Traffic Optimization — Returns spike in January. Make exchanges easy, offer store credit bonuses, recommend alternatives.

Referral Programs — Happy holiday customers are your best marketers. Launch or promote referrals in January with dual incentives.

Community Building — Q5’s quieter vibe is perfect for deepening relationships. Host events, create groups, share customer spotlights, run UGC campaigns.

How to Prepare for Q5

- November: Plan Q5 campaigns alongside holiday ones, brief your team, prep creative for resolutions and fresh starts. Schedule social content calendar through mid-January.

- December: Set up automated flows (post-purchase, abandoned carts, gift card reminders), batch-create January social content, schedule posts for the first two weeks of January, ensure analytics are tracking Q5 metrics.

- During Q5: Monitor daily performance (especially social engagement patterns), adjust targeting, test messaging angles, stay nimble with real-time data. Engage with comments and DMs actively.

- Post Q5: Analyze what worked (which social posts got the most engagement? which ads converted best?), document learnings for next year, use Q5 data to inform Q1 strategy.

Make Your Own Q5 Luck

Q5 isn’t a cooldown period. It’s not an afterthought. It’s a distinct, high-value shopping season with motivated buyers, reduced competition and lower advertising costs. The brands that win Q5 are the ones that show up when everyone else checks out.

While your competitors are posting “out of office” replies, you could be capturing more traffic, converting gift card holders, welcoming resolution-driven shoppers and building loyalty that lasts the entire year.

The post-holiday visibility gap is an opportunity — and it’s sitting there, waiting for you to take it.

Related Articles

Plastic Surgery Marketing: 11 Strategies to Make Your Practice Visible Online

Discover 11 practical plastic surgery marketing strategies to boost online visibility, build trust, and turn website visitors into real consultations.

The Manager You Never Hired: Use Amazon's New AI Agent to Run Your Business Smarter

Tired of juggling Seller Central tabs? Learn how Amazon’s new AI Agent acts like a virtual manager, streamlining operations and optimizing your workflow.

A Beginner’s Guide to Programmatic Display Ads for E-Commerce Brands

Learn how programmatic display advertising helps e-commerce brands scale reach, retarget cart abandoners and build brand awareness with automated, data-driven campaigns.